Money Transfer to Sierra Leone: Available Methods and the Importance of Akaf in Simplifying Financial Transfers

In today’s globalized world, money transfers have become an essential part of daily life. Whether for sending remittances to family members or supporting business transactions, the ability to send money across borders quickly, securely, and affordably is crucial. One of the countries that has witnessed an increasing demand for financial services is Sierra Leone, located in West Africa. Given its developing economy and the significant Sierra Leonean diaspora abroad, there is a growing need for efficient money transfer services. This article will explore the methods available for transferring money to Sierra Leone and discuss the role of Akaf in making the process easier and more reliable.

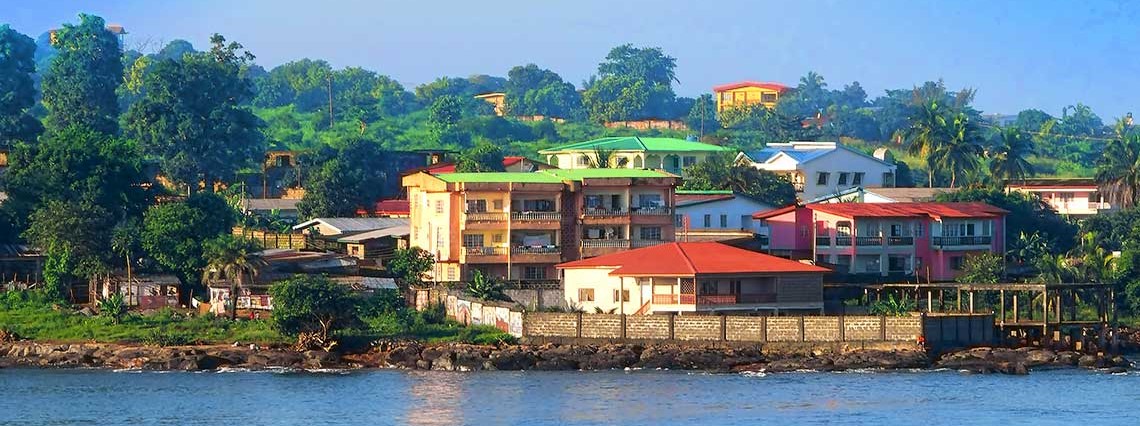

The Economy of Sierra Leone and the Need for Money Transfers

Sierra Leone is a developing country heavily reliant on remittances from its citizens living abroad. The nation faces significant economic challenges, including poverty, lack of infrastructure, and a struggling banking system. As a result, financial remittances from the Sierra Leonean diaspora have become a crucial source of income for many families back home.

These remittances play a vital role in improving the standard of living for many Sierra Leoneans, helping with basic needs like education, healthcare, and housing. Given these pressing needs, it’s critical to provide fast, safe, and cost-effective solutions for transferring money to Sierra Leone.

Methods of Transferring Money to Sierra Leone

There are several methods available for sending money to Sierra Leone, and over the years, the options have grown more diverse and accessible. Some of the most popular methods include:

-

Local and International Banks: Banks offer various services for transferring money to Sierra Leone, whether through traditional wire transfers or online banking services. Some international banks like HSBC and Standard Chartered provide cross-border services that allow users to send money to Sierra Leone quickly and securely. However, these services can be expensive, and the process might take several days.

-

Online Money Transfer Services: Many global companies offer online money transfer services, such as Western Union, MoneyGram, and PayPal. These services allow individuals to send money online to Sierra Leone, with options for receiving the funds either through cash pickup or directly into a bank account. This method is one of the fastest and most popular ways to send money, often completing transfers within minutes.

-

Mobile Money Transfers: In the modern digital age, mobile money services have become increasingly popular in many African countries. In Sierra Leone, individuals can use platforms like Orange Money and Airtel Money to send and receive funds. This method is quick and convenient, as long as the recipient has a mobile phone, even if they do not have a bank account.

-

Cryptocurrency Transfers: In recent years, cryptocurrencies have gained traction as a method for transferring money across borders. Cryptocurrencies like Bitcoin and Ethereum offer a fast and secure way to send money internationally, and there’s growing interest in their use for money transfers in Sierra Leone. However, this method is still relatively new, and greater awareness and regulation are needed for its widespread adoption.

The Role of Akaf in Simplifying Money Transfers

When it comes to financial services, websites and platforms like Akaf have become instrumental in simplifying and enhancing the money transfer process. Akaf is an online platform that enables users to send money internationally with ease and security. Its user-friendly interface makes it accessible for individuals of all backgrounds, providing a simple solution for transferring funds to Sierra Leone.

Akaf stands out by allowing users to compare the rates and services offered by different money transfer providers. The platform provides detailed statistics on fees, exchange rates, and processing times, helping users make informed decisions based on the most cost-effective options available. Additionally, Akaf offers customer support services, ensuring that users can get help with any issues or inquiries they might have during the transfer process.

Moreover, Akaf provides secure and fast money transfer options through various methods, including online payments and mobile wallets. This makes it an ideal choice for those looking to send money to Sierra Leone quickly and at lower costs than traditional banking methods. The platform also allows recipients in Sierra Leone to receive funds in various ways, such as through bank accounts, mobile wallets, or even cash pickup at locations throughout the country.

The Future of Money Transfers to Sierra Leone

As technology advances, the landscape of money transfers to Sierra Leone is set to evolve. With the continued growth of internet and mobile phone penetration in the country, more people will have access to digital money transfer services. Additionally, as cryptocurrencies gain popularity, they may play a larger role in cross-border payments, further reducing transfer times and costs.

Improved money transfer services could help boost Sierra Leone’s economy by making it easier for individuals to send funds and for businesses to engage in international trade. By offering more accessible and affordable financial solutions, Sierra Leone can create new opportunities for economic growth and stability.

Conclusion

Money transfers to Sierra Leone are crucial for the financial well-being of many families and businesses. With a range of available methods, from traditional banking to digital transfers, individuals have more options than ever before. Platforms like Akaf are helping to make these processes smoother, quicker, and more affordable. As technology continues to improve, the future of money transfers in Sierra Leone looks promising, offering greater financial inclusion and economic development for the country.

Related Blog

25 Jul 2024 | Money Transfer

Yuan transfers from the Akaaf website

Sending yuan to China via the AKAAF website is a secure and efficient method for...

25 Jul 2024 | Money Transfer

Transfer money to Pakistan

The AKAAF online exchange center offers remittance payments to Pakistan, facilit...

25 Jul 2024 | Money Transfer

Transfer Money To India

Traveling or migrating to India requires reliable currency exchange services. Wh...

Comments

Total 0 comment in the post